Archive for Between the Lines

Obama’s Misleading $3.7 Billion For Border Crisis

by Gary D. Halbert Between the Lines President Obama came to Texas earlier this month to attend three fundraising events – you know, the trip when he refused to visit the Texas/Mexico border to see the crisis first-hand. It was during that visit when he first said he needed $2…

Fed’s QE Ending in October: A Success or Failure?

by Gary D. Halbert Between the Lines The Fed confirmed last week what we all had expected: it will end its massive QE bond buying program by the end of October. No surprise there. The question is, was QE a success, a failure or somewhere in between? Some argue that…

Border Crisis – Why The Masses Are Coming

by Gary D. Halbert Between the Lines In my June 17 E-Letter, I focused on the border crisis in South Texas. Today’s post is an update. The government now admits that it has seen 52,000 unaccompanied illegal children cross our border this year and expects that number to reach at…

Consumer Confidence Highest Since 2008

by Gary D. Halbert Between the Lines With yesterday morning’s awful report on 1Q GDP, many people quickly forgot that another report on Tuesday showed consumer confidence rose this month to the highest level since January 2008. Remember that consumer spending makes up almost 70% of GDP, so rising…

Fed Dials-Down Its 2014 Economic Forecast

Between the Lines by Gary D. Halbert The Fed Open Market Committee (FOMC) concluded its latest two-day policy meeting yesterday with no big surprises in its formal policy statement. Yet the Fed significantly reduced its forecast for economic growth this year, as I will discuss below. In yesterday’s policy statement,…

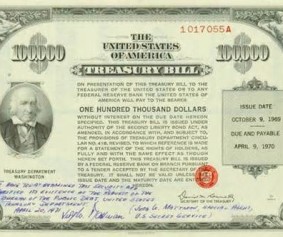

Why Treasury Prices Are Rising This Year

Between the Lines by Gary D. Halbert To the surprise of most forecasters, US long-dated Treasury prices have risen significantly this year, even as the Fed continues to wind-down its QE purchases. When Treasury prices rise, yields (interest rates) fall. The yield on 10-year Treasury notes plunged below 2.5% in…