How to Marry a Millionaire… And Not Die a Pauper

Tuesday, September 3rd, 2013 @ 5:01PM

By Dennis Miller

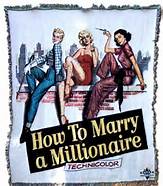

A recent article penned by Jeff Sommer for The New York Times noted that in 1953, when How to Marry a Millionaire – one of Marilyn Monroe’s more endearing comedic performances – debuted, $1 million was worth much more than it is now. It was the equivalent of $8.7 million in today’s dollars.

Much like the old gray mare who is past her prime, a million dollars sure ain’t what it used to be. In 1953, a family with a net worth of $1 million easily resided in the top 1% of all US households; now they’re just in the top 10%.

For many decades, folks imagined that being a millionaire meant never having to worry about money again. Millionaires were living on easy street, or so people thought. Sommer and I agree – that idea is an illusion. For retirees, $1 million certainly does not make one wealthy, especially if a large part of that money is wrapped up in one’s home.

There’s a Good Chance You Will Outlive Your Money

Sommer goes on to write:

“[C]onsider this bleak picture: A typical 65-year-old couple with $1 million in tax-free municipal bonds want to retire. They plan to withdraw 4 percent of their savings a year – a common, rule-of-thumb drawdown. But under current conditions, if they spend that $40,000 a year, adjusted for inflation, there is a 72 percent probability that they will run through their bond portfolio before they die. …

f they withdrew 3 percent, or $30,000, a year, rather than that standard rate of 4 percent, inflation-adjusted, there is still a one-in-three chance that they will outlive their money, under current market conditions.”

As an aging stallion who has spent many years pulling the load with his wonderful mare, I know that the solution to our predicament is more complicated than simply changing a number in a computer projection. Retirees need to look beyond the old retirement formulas if they want their money to last.

The old formula was simple: Retirees could expect a 6% return on their portfolios, factor in a 2% rate of inflation, and still net a 4% return to live off of without touching their principal. That was easy when CDs and high-quality bonds could be counted on for at least 6%.

The foundation of that formula was the adage, “live off the interest and never touch the principal.” For several generations it was nothing short of gospel. If your principal remained intact, you never had to worry about running out of money. I do not know anyone who would be comfortable watching their nest egg dwindle away every year. It is terrifying!

A Retirement Formula for 2013 and Beyond

Consider the three variables in the old formula: expected return; rate of inflation; and the percentage one can withdraw each year. These days the numbers we can safely assign to those variables are all moving at the same time.

To begin with, retirees can no longer expect a 6% return on ultra-safe investments like CDs and top-rated bonds. Not anymore; the yields are not even close. That means retirees have to put much more of their money at risk.

Then there’s that ridiculous 2% inflation rate. Regular Miller’s Money Weekly readers will recall our inflation survey, in which 98.6% of the thousands of folks who participated thought inflation was much higher than the government-reported rate of 2%. At the end of the day, we each have to plan for increases to the goods and services we actually spend our money on. For seniors, that means paying particular attention to health care and long-term care costs – and if we’re lucky, greens fees and baseball tickets too. Whatever your personal inflation rate is, I highly doubt it’s only 2%.

Planning becomes difficult when we don’t know which numbers to plug in. If we believe inflation is 5% and we still want to withdraw 4% from our portfolio each year, we must earn 9% to keep our buying power intact. Even if our inflation estimate is correct, a 9% return from conservative investments is an ambitious goal.

Don’t Plan Your Retirement Around Expectations

The Times article also points out the recent increase in the yield of 10-year Treasury notes and states:

“Rates are expected to rise… Yet yields remain extraordinarily low on a historical basis. The yield on the benchmark 10-year Treasury note is just under 2.2 percent, compared with more than 6.5 percent, on average, since 1962, according to quarterly Bloomberg data.”

While guaranteed yields may be rising, are they rising fast enough to make a difference in our retirement plans? With the government creating $1 trillion a year in new money, we can’t start thinking “happy days are here again” until we are comfortable that these yields are – and will remain – well above the inflation rate.

If the inflation rate is higher than the return on our investments, then we have several uncomfortable choices:

- Put more money in moderate-risk investments in hope of a higher return.

- Move money already in moderate-risk investments into high-risk investments.

- Take out less money from one’s portfolio each year to supplement Social Security, and adjust one’s lifestyle accordingly.

- Tap into principal and watch the nest egg dwindle.

- Continue to work.

As my colleague John Mauldin likes to say, the technical term for any of the choices is “screwed.”

Is It Still Possible to Enjoy Retirement?

Sure it is! If you’re in the top 1% in terms of net worth, you probably have enough money to last a lifetime, even if you do tap into the principal. For the rest of us mere mortals, the retirement game has changed, but it’s still playable.

On a side note, I caution anyone working with a financial planner not to be lulled to sleep by their projections. Their calculations may be mathematically accurate, but the variables they plug in to their fancy computer programs may not match the ever-changing real world, and those projections certainly have a short shelf life. Financial projections should be regularly revised; otherwise they become stale very quickly.

Nevertheless, no matter where we fall in terms of net worth – top 1%, top 10%, or top 50% – we want to maintain our lifestyle during retirement without having to constantly worry. That is a common thread we all share.

In my opinion, the key is becoming self-educated. At Money Forever, we offer a library of educational resources for our subscribers. Even folks who have professional help need to learn as much as possible about investing. The more we know, the less we worry.

While this old grey stallion ain’t what he used to be, my mind is still intact (thank goodness). The government bailed out banks at the expense of an entire generation. But we can still adjust our investment strategies and enjoy retirement. We cannot, however, allow ourselves to be fooled by the illusion of wealth.

Posted by AIA Research & Editorial Staff

Categories: AIA Newsletter