Before & After Today’s Important Fed Decision

Thursday, June 20th, 2013 @ 2:58PM

Between the Lines

by Gary D. Halbert

(written on Wednesday, June 19, 2013)

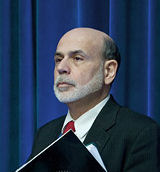

I begin this posting about a half hour before the Fed makes its important policy announcement from the FOMC and about an hour before Fed Chairman Bernanke is scheduled to hold a press conference. CNBC has spent the entire morning interviewing guest after guest and asking them to speculate about what the Fed’s decision will be today.

The main question is whether or not the FOMC will vote to reduce the $85 billion monthly purchases of Treasury bonds ($45 billion) and mortgage-backed securities ($40 billion). Most of the guests on CNBC this morning felt that the Fed would move to reduce these QE purchases at this meeting. I have speculated that such a decision would not come until the September meeting when Bernanke is scheduled to hold another post-meeting press conference.

Bloomberg surveyed 59 economists earlier this month, asking the same question: When will the Fed begin to reduce QE? The median estimate was that the Fed will cut its monthly purchases to $65 billion, but not until the October 29-30 FOMC meeting. I question that only because Bernanke is not scheduled to hold a press conference following that meeting.

I would think the FOMC would only make such an announcement at a time when Bernanke can address the press and spin the decision however he wishes. He has only three press conferences scheduled for the rest of this year: Today, September 18 and December 18.

Today’s important announcement will be released in just a few minutes, and I will resume writing this afterward. At the moment, stocks and bonds are pretty flat on the day, but that will change – perhaps significantly – depending on the Fed’s announcement in a couple of minutes.

No “Tapering”

The report is out and the FOMC voted to continue the $85 billion in monthly bond and mortgage purchases for the time being. The Fed’s balance sheet is now over $3.4 trillion and will continue to rise rapidly based on today’s announcement. The Fed also expects to hold the Fed Funds rate at zero to 0.25% at least through 2014.

The policy statement notes that “the downside risks to the outlook for the economy and the labor market as having diminished since the fall.” That is an improvement from the language in the May 1 statement which read: “The Committee continues to see downside risks to the economic outlook.”

This seemingly small change in the outlook for the economy may be the Fed’s way of signaling that it may move to reduce QE purchases before long. I’m sticking with my guess that it will happen at the September 17-18 FOMC meeting.

The surprise is that stocks and bonds moved lower immediately after the FOMC statement. Many had thought that if the Fed voted to continue the $85 billion in monthly purchases, it would be bullish for stocks and bonds, both of which had moved somewhat lower over the last couple of weeks in anticipation of today’s announcement.

At one hour after the announcement, the Dow is down 150 points, and the 30-year bond yield jumped up to 3.42% from 3.35% ahead of the announcement. The yield of 3.42% is a breakout of the recent trading range. In theory, today’s announcement should be good news for both stocks and bonds, but so far it’s just the opposite.

Posted by AIA Research & Editorial Staff

Categories: Between the Lines

Tags: Bernanke, Fed, QE